Why Aging in Place Is the New Reality for Most Baby Boomers

Headlines across the country warn of a housing market squeezed by low inventory, but the root cause may surprise you. According to Wall Street analyst Meredith Whitney, it’s not just young families struggling to find homes—many older adults simply can’t afford to move.

Despite the common belief that this generation is sitting on vast wealth, Whitney shared in a recent Bloomberg interview that only about 10% of seniors can afford assisted living facilities (1). The rest? They’re staying put, choosing to age in place in the homes they’ve known for decades.

At Clara, we see this trend play out every day. More and more families are navigating the financial and emotional complexities of supporting aging parents who want to remain in their own homes. For many, this isn’t just a matter of preference—it’s a necessity shaped by today’s economic realities.

Aging in Place: The Preferred-and Sometimes Only-Choice

For most seniors, remaining in their own homes isn’t just about finances. It’s about comfort, familiarity, and dignity. Surveys consistently show that the vast majority of older adults prefer to age in place (2), surrounded by cherished memories and close to their communities. Home is where they feel safest and most independent.

But economic factors are making this preference even more pronounced. Elevated mortgage rates have created a “lock-in” effect, making homeowners reluctant to give up their low-rate mortgages for today’s higher borrowing costs. For older adults, selling the family home often just doesn’t make financial sense anymore. Even for those who might consider downsizing, the lack of affordable alternatives and the high costs of assisted living facilities put those options out of reach for many.

While some headlines focus on homebuyers, the reality for most older adults is a struggle to maintain their current living situation. Nearly half of all home-equity loans are now being taken out by seniors-a clear sign that many are tapping into their home’s value just to make ends meet. The idea of the universally wealthy older American is largely a myth.

The Realities Behind the Headlines

The numbers tell a sobering story:

Only about 10% of seniors can afford assisted living facilities.

Nearly half of home-equity loans are now issued to seniors.

Many seniors are living on fixed incomes, with little room for unexpected expenses.

These realities are reshaping not just the housing market, but the entire landscape of senior care in America. Families are stepping up to fill the gaps, often juggling work, childcare, and caregiving responsibilities. (Read more about the "Sandwich Generation" here).

Why Aging in Place Matters

Beyond economics, aging in place offers emotional and health benefits. Seniors who remain in their homes often report higher satisfaction, better mental health, and a stronger sense of independence. Familiar surroundings can reduce confusion and anxiety, especially for those with memory challenges. Staying close to neighbors, friends, and local services helps seniors stay connected and engaged, avoiding the loneliness and social isolation that can come with age.

How Families Can Support Aging in Place

If you’re supporting an aging parent or relative who wants to remain at home, you’re not alone. Here are three steps to help navigate this new reality:

Explore Flexible Care Options

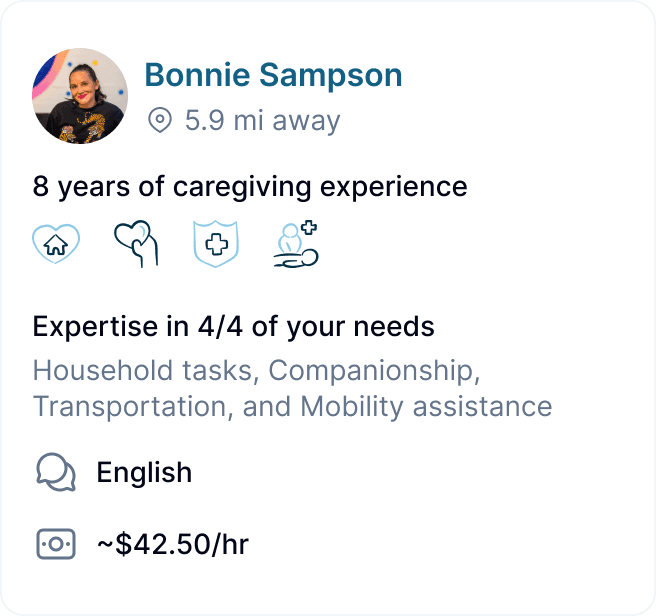

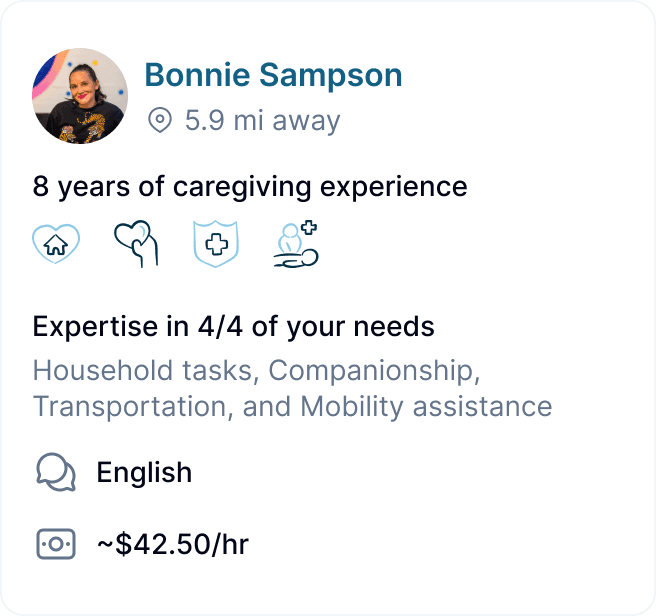

Traditional home care solutions often require high minimum hours and long-term contracts, which can be daunting for families on a budget. Clara connects families with independent caregivers for the hours they need—no more, no less. This approach makes in-home care more affordable and adaptable for seniors living on fixed incomes.

Plan Proactively

Don’t wait for a crisis to start planning. As aging in place becomes the norm, building a care plan early allows families to find the right caregiver match and avoid rushed decisions later. Clara’s team can help you assess your loved one’s needs and develop a personalized plan that evolves as those needs change.

Get Help with the Logistics

Hiring a private caregiver can be one of the most affordable ways to support aging in place, but managing background checks, payroll, taxes, and legal requirements can feel overwhelming. Clara handles all these details, so families can focus on what matters most: providing loving, attentive care.

The Benefits of In-Home Care

In-home care isn’t just about convenience-it’s about preserving quality of life. The comfort of home enhances well-being, reduces stress, and helps seniors maintain routines that are meaningful to them. Family involvement is easier, and care can be personalized to fit changing needs/ For those recovering from illness or surgery, being at home can even speed up recovery and reduce the risk of complications.

The Future of Aging in America

The financial pressures Meredith Whitney describes aren’t just statistics—they’re shaping the future of aging in America. As more older adults remain in their homes longer, the need for smart, affordable, and flexible care solutions will only grow. Aging in place is quickly becoming the default, not just because it’s what seniors want, but because it’s often the only viable option.

At Clara, we’re committed to making this transition as smooth as possible. We believe that every senior deserves to age with dignity, comfort, and the support they need—right at home.

Let Clara Help Your Family

If your family is facing the challenges of supporting an aging loved one at home, Clara is here to help. Our flexible, affordable approach to in-home care connects you with experienced caregivers who understand the unique needs of seniors. We handle the logistics, so you can focus on what matters most.

Reach out to us today to learn more about how we can support your family’s journey.

References

Headlines across the country warn of a housing market squeezed by low inventory, but the root cause may surprise you. According to Wall Street analyst Meredith Whitney, it’s not just young families struggling to find homes—many older adults simply can’t afford to move.

Despite the common belief that this generation is sitting on vast wealth, Whitney shared in a recent Bloomberg interview that only about 10% of seniors can afford assisted living facilities (1). The rest? They’re staying put, choosing to age in place in the homes they’ve known for decades.

At Clara, we see this trend play out every day. More and more families are navigating the financial and emotional complexities of supporting aging parents who want to remain in their own homes. For many, this isn’t just a matter of preference—it’s a necessity shaped by today’s economic realities.

Aging in Place: The Preferred-and Sometimes Only-Choice

For most seniors, remaining in their own homes isn’t just about finances. It’s about comfort, familiarity, and dignity. Surveys consistently show that the vast majority of older adults prefer to age in place (2), surrounded by cherished memories and close to their communities. Home is where they feel safest and most independent.

But economic factors are making this preference even more pronounced. Elevated mortgage rates have created a “lock-in” effect, making homeowners reluctant to give up their low-rate mortgages for today’s higher borrowing costs. For older adults, selling the family home often just doesn’t make financial sense anymore. Even for those who might consider downsizing, the lack of affordable alternatives and the high costs of assisted living facilities put those options out of reach for many.

While some headlines focus on homebuyers, the reality for most older adults is a struggle to maintain their current living situation. Nearly half of all home-equity loans are now being taken out by seniors-a clear sign that many are tapping into their home’s value just to make ends meet. The idea of the universally wealthy older American is largely a myth.

The Realities Behind the Headlines

The numbers tell a sobering story:

Only about 10% of seniors can afford assisted living facilities.

Nearly half of home-equity loans are now issued to seniors.

Many seniors are living on fixed incomes, with little room for unexpected expenses.

These realities are reshaping not just the housing market, but the entire landscape of senior care in America. Families are stepping up to fill the gaps, often juggling work, childcare, and caregiving responsibilities. (Read more about the "Sandwich Generation" here).

Why Aging in Place Matters

Beyond economics, aging in place offers emotional and health benefits. Seniors who remain in their homes often report higher satisfaction, better mental health, and a stronger sense of independence. Familiar surroundings can reduce confusion and anxiety, especially for those with memory challenges. Staying close to neighbors, friends, and local services helps seniors stay connected and engaged, avoiding the loneliness and social isolation that can come with age.

How Families Can Support Aging in Place

If you’re supporting an aging parent or relative who wants to remain at home, you’re not alone. Here are three steps to help navigate this new reality:

Explore Flexible Care Options

Traditional home care solutions often require high minimum hours and long-term contracts, which can be daunting for families on a budget. Clara connects families with independent caregivers for the hours they need—no more, no less. This approach makes in-home care more affordable and adaptable for seniors living on fixed incomes.

Plan Proactively

Don’t wait for a crisis to start planning. As aging in place becomes the norm, building a care plan early allows families to find the right caregiver match and avoid rushed decisions later. Clara’s team can help you assess your loved one’s needs and develop a personalized plan that evolves as those needs change.

Get Help with the Logistics

Hiring a private caregiver can be one of the most affordable ways to support aging in place, but managing background checks, payroll, taxes, and legal requirements can feel overwhelming. Clara handles all these details, so families can focus on what matters most: providing loving, attentive care.

The Benefits of In-Home Care

In-home care isn’t just about convenience-it’s about preserving quality of life. The comfort of home enhances well-being, reduces stress, and helps seniors maintain routines that are meaningful to them. Family involvement is easier, and care can be personalized to fit changing needs/ For those recovering from illness or surgery, being at home can even speed up recovery and reduce the risk of complications.

The Future of Aging in America

The financial pressures Meredith Whitney describes aren’t just statistics—they’re shaping the future of aging in America. As more older adults remain in their homes longer, the need for smart, affordable, and flexible care solutions will only grow. Aging in place is quickly becoming the default, not just because it’s what seniors want, but because it’s often the only viable option.

At Clara, we’re committed to making this transition as smooth as possible. We believe that every senior deserves to age with dignity, comfort, and the support they need—right at home.

Let Clara Help Your Family

If your family is facing the challenges of supporting an aging loved one at home, Clara is here to help. Our flexible, affordable approach to in-home care connects you with experienced caregivers who understand the unique needs of seniors. We handle the logistics, so you can focus on what matters most.

Reach out to us today to learn more about how we can support your family’s journey.

References

Headlines across the country warn of a housing market squeezed by low inventory, but the root cause may surprise you. According to Wall Street analyst Meredith Whitney, it’s not just young families struggling to find homes—many older adults simply can’t afford to move.

Despite the common belief that this generation is sitting on vast wealth, Whitney shared in a recent Bloomberg interview that only about 10% of seniors can afford assisted living facilities (1). The rest? They’re staying put, choosing to age in place in the homes they’ve known for decades.

At Clara, we see this trend play out every day. More and more families are navigating the financial and emotional complexities of supporting aging parents who want to remain in their own homes. For many, this isn’t just a matter of preference—it’s a necessity shaped by today’s economic realities.

Aging in Place: The Preferred-and Sometimes Only-Choice

For most seniors, remaining in their own homes isn’t just about finances. It’s about comfort, familiarity, and dignity. Surveys consistently show that the vast majority of older adults prefer to age in place (2), surrounded by cherished memories and close to their communities. Home is where they feel safest and most independent.

But economic factors are making this preference even more pronounced. Elevated mortgage rates have created a “lock-in” effect, making homeowners reluctant to give up their low-rate mortgages for today’s higher borrowing costs. For older adults, selling the family home often just doesn’t make financial sense anymore. Even for those who might consider downsizing, the lack of affordable alternatives and the high costs of assisted living facilities put those options out of reach for many.

While some headlines focus on homebuyers, the reality for most older adults is a struggle to maintain their current living situation. Nearly half of all home-equity loans are now being taken out by seniors-a clear sign that many are tapping into their home’s value just to make ends meet. The idea of the universally wealthy older American is largely a myth.

The Realities Behind the Headlines

The numbers tell a sobering story:

Only about 10% of seniors can afford assisted living facilities.

Nearly half of home-equity loans are now issued to seniors.

Many seniors are living on fixed incomes, with little room for unexpected expenses.

These realities are reshaping not just the housing market, but the entire landscape of senior care in America. Families are stepping up to fill the gaps, often juggling work, childcare, and caregiving responsibilities. (Read more about the "Sandwich Generation" here).

Why Aging in Place Matters

Beyond economics, aging in place offers emotional and health benefits. Seniors who remain in their homes often report higher satisfaction, better mental health, and a stronger sense of independence. Familiar surroundings can reduce confusion and anxiety, especially for those with memory challenges. Staying close to neighbors, friends, and local services helps seniors stay connected and engaged, avoiding the loneliness and social isolation that can come with age.

How Families Can Support Aging in Place

If you’re supporting an aging parent or relative who wants to remain at home, you’re not alone. Here are three steps to help navigate this new reality:

Explore Flexible Care Options

Traditional home care solutions often require high minimum hours and long-term contracts, which can be daunting for families on a budget. Clara connects families with independent caregivers for the hours they need—no more, no less. This approach makes in-home care more affordable and adaptable for seniors living on fixed incomes.

Plan Proactively

Don’t wait for a crisis to start planning. As aging in place becomes the norm, building a care plan early allows families to find the right caregiver match and avoid rushed decisions later. Clara’s team can help you assess your loved one’s needs and develop a personalized plan that evolves as those needs change.

Get Help with the Logistics

Hiring a private caregiver can be one of the most affordable ways to support aging in place, but managing background checks, payroll, taxes, and legal requirements can feel overwhelming. Clara handles all these details, so families can focus on what matters most: providing loving, attentive care.

The Benefits of In-Home Care

In-home care isn’t just about convenience-it’s about preserving quality of life. The comfort of home enhances well-being, reduces stress, and helps seniors maintain routines that are meaningful to them. Family involvement is easier, and care can be personalized to fit changing needs/ For those recovering from illness or surgery, being at home can even speed up recovery and reduce the risk of complications.

The Future of Aging in America

The financial pressures Meredith Whitney describes aren’t just statistics—they’re shaping the future of aging in America. As more older adults remain in their homes longer, the need for smart, affordable, and flexible care solutions will only grow. Aging in place is quickly becoming the default, not just because it’s what seniors want, but because it’s often the only viable option.

At Clara, we’re committed to making this transition as smooth as possible. We believe that every senior deserves to age with dignity, comfort, and the support they need—right at home.

Let Clara Help Your Family

If your family is facing the challenges of supporting an aging loved one at home, Clara is here to help. Our flexible, affordable approach to in-home care connects you with experienced caregivers who understand the unique needs of seniors. We handle the logistics, so you can focus on what matters most.

Reach out to us today to learn more about how we can support your family’s journey.

References

More about senior health

More about senior health

Peace of Mind: How Meditation Supports Seniors and Their Caregivers

Lowrie Hilladakis

Osteoporosis in Older Adults: What Every Caregiver Should Know

Clara Editorial Team

Warning Signs Of Vision Loss In Seniors—And What To Do Next

Clara Editorial Team

“They Were Talking to Each Other, But Not to Me”: Understanding the Patient Experience During Hospital-to-SNF Transitions

Clara Editorial Team

Talking About Therapy: How to Normalize Mental Health Support with Aging Parents

Lowrie Hilladakis

Stroke Awareness Month: Navigating Recovery After the Crisis

Clara Editorial Team

Digestive Health Tips for Seniors: Why It’s Often Overlooked

Clara Editorial Team

What Is A Care Manager?

Camille Christie

The Physical and Mental Health Benefits of Gardening for Seniors

Quynh Thi Pham, OTS

Stay Sharp, Stay Happy: Fun ways to keep our mind active as we age!

Neelam Dabholkar, MBA

GEt started for free

Better care starts with Clara.

Find, hire, and pay top-notch caregivers without the headache for a price that fits your budget.

GEt started for free

Better care starts with Clara.

Find, hire, and pay top-notch caregivers without the headache for a price that fits your budget.

GEt started for free

Better care starts with Clara.

Find, hire, and pay top-notch caregivers without the headache for a price that fits your budget.